U.S. Charges 4 Chinese Military Officers in 2017 Equifax Hack

Credit to Author: BrianKrebs| Date: Tue, 11 Feb 2020 03:25:52 +0000

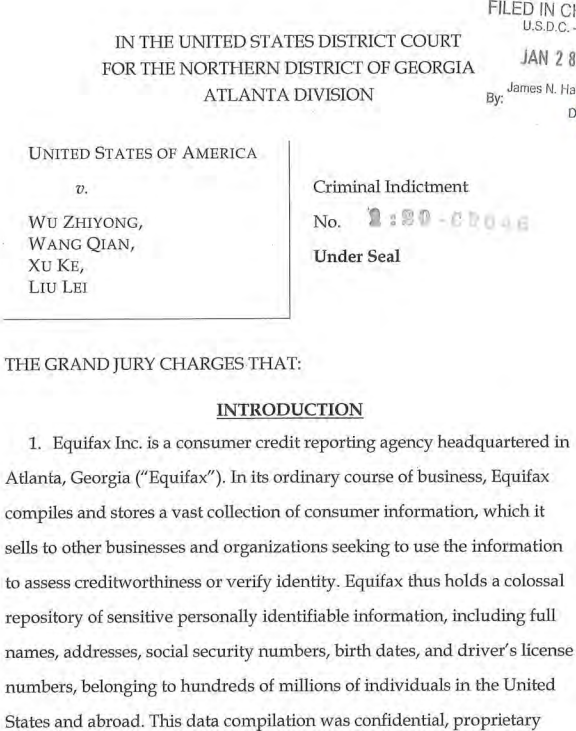

The U.S. Justice Department today unsealed indictments against four Chinese officers of the People’s Liberation Army (PLA) accused of perpetrating the 2017 hack against consumer credit bureau Equifax that led to the theft of personal data on nearly 150 million Americans. DOJ officials said the four men were responsible for carrying out the largest theft of sensitive personal information by state-sponsored hackers ever recorded.

The nine-count indictment names Wu Zhiyong (吴志勇), Wang Qian (王乾), Xu Ke (许可) and Liu Lei (刘磊) as members of the PLA’s 54th Research Institute, a component of the Chinese military. They are each charged with three counts of conspiracy to commit computer fraud, economic espionage and wire fraud.

The nine-count indictment names Wu Zhiyong (吴志勇), Wang Qian (王乾), Xu Ke (许可) and Liu Lei (刘磊) as members of the PLA’s 54th Research Institute, a component of the Chinese military. They are each charged with three counts of conspiracy to commit computer fraud, economic espionage and wire fraud.

The government says the men disguised their hacking activity by routing attack traffic through 34 servers located in nearly 20 countries, using encrypted communications channels within Equifax’s network to blend in with normal network activity, and deleting log files daily to remove evidence of their meanderings through the company’s systems.

U.S. Attorney General Bill Barr said at a press conference today that the Justice Department doesn’t normally charge members of another country’s military with crimes (this is only the second time the agency has indicted Chinese military hackers). But in a carefully worded statement that seemed designed to deflect any criticism of past offensive cyber actions by the U.S. military against foreign targets, Barr said the DOJ did so in this case because the accused “indiscriminately” targeted American civilians on a massive scale.

“The United States, like other nations, has gathered intelligence throughout its history to ensure that national security and foreign policy decision makers have access to timely, accurate and insightful information,” Barr said. “But we collect information only for legitimate national security purposes. We don’t indiscriminately violate the privacy of ordinary citizens.”

FBI Deputy Director David Bowdich sought to address the criticism about the wisdom of indicting Chinese military officers for attacking U.S. commercial and government interests. Some security experts have charged that such indictments could both lessen the charges’ impact and leave American officials open to parallel criminal allegations from Chinese authorities.

“Some might wonder what good it does when these hackers are seemingly beyond our reach,” Bowdich said. “We answer this question all the time. We can’t take them into custody, try them in a court of law and lock them up. Not today, anyway. But one day these criminals will slip up, and when they do we’ll be there. We in law enforcement will not let hackers off the hook just because they’re halfway around the world.”

The attorney general said the attack on Equifax was just the latest in a long string of cyber espionage attacks that sought trade secrets and sensitive data from a broad range of industries, and including managed service providers and their clients worldwide, as well as U.S. companies in the nuclear power, metals and solar products industries.

“Indeed, about 80 percent of our economic espionage prosecutions have implicated the Chinese government, and about 60 percent of all trade secret thefts cases in recent years involved some connection with China,” he said.

The indictments come on the heels of a conference held by US government officials this week that detailed the breadth of hacking attacks involving the theft of intellectual property by Chinese entities.

“The FBI has about a thousand investigations involving China’s attempted theft of U.S.-based technology in all 56 of our field offices and spanning just about every industry and sector,” FBI Director Christopher Wray reportedly told attendees at the gathering in Washington, D.C., dubbed the “China Initiative Conference.”

At a time when increasingly combative trade relations with China combined with public fears over the ongoing Coronavirus flu outbreak are stirring Sinophobia in some pockets of the U.S. and other countries, Bowdich was quick to clarify that the DOJ’s beef was with the Chinese government, not its citizenry.

“Our concern is not with the Chinese people or with the Chinese American,” he said. “It is with the Chinese government and the Chinese Communist Party. Confronting this threat directly doesn’t mean we should not do business with China, host Chinese students, welcome Chinese visitors or co-exist with China as a country on the world stage. What it does mean is when China violates our criminal laws and international norms, we will hold them accountable for it.”

A copy of the indictment is available here.

ANALYSIS

DOJ officials praised Equifax for their “close collaboration” in sharing data that helped investigators piece together this whodunnit. Attorney General Barr noted that the accused not only stole personal and in some cases financial data on Americans, they also stole Equifax’s trade secrets, which he said were “embodied by the compiled data and complex database designs used to store personal information.”

While the DOJ’s announcement today portrays Equifax in a somewhat sympathetic light, it’s important to remember that Equifax repeatedly has proven itself an extremely poor steward of the highly sensitive information that it holds on most Americans.

Equifax’s actions immediately before and after its breach disclosure on Sept 7, 2017 revealed a company so inept at managing its public response that one couldn’t help but wonder how it might have handled its internal affairs and security. Indeed, Equifax and its leadership careened from one feckless blunder to the next in a series of debacles that KrebsOnSecurity described at the time as a complete “dumpster fire” of a breach response.

For starters, the Web site that Equifax set up to let consumers check if they were affected by the breach consistently gave conflicting answers, and was initially flagged by some Web browsers as a potential phishing site.

Compounding the confusion, on Sept. 19, 2017, Equifax’s Twitter account told people looking for information about the breach to visit the wrong Web site, which also was blocked by multiple browsers as a phishing site.

And two weeks after its breach disclosure, Equifax began notifying consumers of their eligibility to enroll in free credit monitoring — but the messages did not come from Equifax’s domain and were in many other ways indistinguishable from a phishing attempt.

It soon emerged the intruders had gained access to Equifax’s systems by attacking a software vulnerability in an Internet-facing server that had been left unpatched for four months after security experts warned that the flaw was being broadly exploited. We also learned that the server in question was tied to an online dispute portal at Equifax, which the intruders quickly seeded with tools that allowed them to maintain access to the credit bureau’s systems.

This is especially notable because on Sept. 12, 2017 — just five days after Equifax went public with its breach — KrebsOnSecurity broke the news that the administrative account for a separate Equifax dispute resolution portal catering to consumers in Argentina was wide open, protected by perhaps the most easy-to-guess password combination ever: “admin/admin.”

A partial list of active and inactive Equifax employees in Argentina. This page also let anyone add or remove users at will, or modify existing user accounts.

Perhaps we all should have seen this megabreach coming. In May 2017, KrebsOnSecurity detailed how countless employees at many major U.S. companies suffered tax refund fraud with the IRS thanks to a laughably insecure portal at Equifax’s TALX payroll division, which provides online payroll, HR and tax services to thousands of U.S. firms.

Equifax’s TALX — now called Equifax Workforce Solutions — aided tax thieves by relying on outdated and insufficient consumer authentication methods.

In October 2017, KrebsOnSecurity showed how easy it was to learn the complete salary history of a large portion of Americans simply by knowing someone’s Social Security number and date of birth, thanks to yet another Equifax portal.

Around that same time, we also learned that at least two Equifax executives sought to profit from the disaster through insider trading just days prior to the breach announcement. Jun Ying, Equifax’s former chief information officer, dumped all of his stock in the company in late August 2017, realizing a gain of $480,000 and avoiding a loss of more than $117,000 when news of the breach dinged Equifax’s stock price.

Sudhakar Reddy Bonthu, a former manager at Equifax who was contracted to help the company with its breach response, bought 86 “put” options in Equifax stock on Sept. 1, 2017 that allowed him to profit when the company’s share price dropped. Bonthu was later sentenced to eight months of home confinement; Ying got four months in prison and one year of supervised release. Both were fined and/or ordered to pay back their ill-gotten gains.

While Equifax’s stock price took a steep hit in the months following its breach disclosure, shares in the company [NYSE:EFX] gained a whopping 50.5% in 2019, according to data from S&P Global Market Intelligence.

KrebsOnSecurity has long maintained that the 2017 breach at Equifax was not the work of financially-motivated identity thieves, as there has been exactly zero evidence to date that anything close to the size of the data cache stolen from that incident has shown up for sale in the cybercrime underground.

However, readers should understand that there are countless other companies with access to SSN, DOB and other information crooks need to apply for credit in your name that get hacked all the time, and that this data on a great many Americans is already for sale across various cybercrime bazaars.

Readers also should know that while identity theft protection services of the kind offered by Equifax and other companies may alert you if crooks open a new line of credit in your name, these services generally do nothing to stop that identity theft from taking place. ID theft protection services are most useful in helping people recover from such crimes.

As such, KrebsOnSecurity continues to encourage readers to place a freeze on their credit files with Equifax and the other major credit bureaus. This process puts you in control over who gets to grant credit in your name. Placing a freeze is now free for all Americans and their dependents. For more information on how to do that and what to expect from a freeze, please see this primer.