Koinly Review: Helping You Manage and Calculate Your Crypto Taxes

Credit to Author: Jeremy Wells| Date: Tue, 19 Nov 2019 12:47:48 +0000

Koinly is an online platform for calculating your crypto taxes and tracking your portfolio. As it supports more than 100 countries, Koinly allows people from all around the world to generate their crypto tax reports.

Crypto taxes have become a hot topic recently, with the IRS, HMRC, and other tax authorities cracking down on crypto traders with unpaid taxes. Crypto taxes are not something that can just be ignored and must be taken seriously to avoid repercussions later.

As crypto moves from its wild west phase towards global mainstream adoption, it makes sense to have a system for managing your taxes in place now ready for the years ahead. Koinly wants to be the platform that allows you to do this in the most efficient way.

In this review, I’ll take an in-depth look at Koinly and its different features to provide you with a complete rundown of this cryptocurrency tax management platform.

Importing Your Data

In order to calculate your crypto taxes accurately, you will need the data of all your crypto transactions and their associated fees.

Koinly allows you to import your data from more than 300 exchanges, 68 wallets, 6000 blockchains, and various other platforms, so gathering all of the necessary data together shouldn’t be a problem.

Even if you use a service that is not integrated with Koinly, you can download your transactions in an Excel or CSV format, and Koinly will help you import the file.

Once you have connected your data sources via their API keys or public addresses, your data will then automatically sync with Koinly when you make any future transactions.

Koinly has made this whole process extremely easy, allowing you to connect the exchanges, wallets, and other crypto services you use in minutes.

Generating Tax Reports

Koinly collaborated with expert tax consultants from KPMG during its development to ensure that the reports generated are compliant with relevant tax laws. The platform allows users to generate tax reports for countries that accept LIFO, FIFO, and Average Cost accounting methods, which is almost every country.

Capital gains reports can be made using more than 5 years of historical market data for 6000+ fiat and digital currencies. You can also use the income from staking, mining, and loans to generate reports, as well as account for gifted, donated, and lost coins.

If you are ever audited, Koinly will provide you the fully compliant transaction logs you need and cost-basis calculations. It also allows you to export your data from Koinly to other tax filing systems, such as Xero, TurboTax, and TaxAct.

By being able to easily import and review all of your crypto transactions on Koinly, it allows users to save hours of time and dramatically reduces the risk of errors when calculating tax reports. Koinly notifies you if transactions still need to be reviewed, or if something does not seem right with a transaction, like a negative balance, for example, helping to ensure accuracy.

Koinly also has a built-in chat feature that allows you to drop them a message if you ever need help with anything related to the platform or your taxes.

On top of being a user-friendly tax calculator, Koinly also has a built-in portfolio tracker that has features designed to help users reduce their tax bills. This includes insights on how trades can affect your taxes before making them and notifying users of tax-loss harvesting opportunities.

A Closer Look at Koinly’s Portfolio Tracker

Aside from the tax benefits that Koinly’s portfolio tracker can bring, it also allows you to visualize your complete crypto portfolio, spread across multiple exchanges and services, all in one place.

It provides you a breakdown of your holdings and the ROI for each. You can see how the total value of your portfolio has increased and decreased over time, the amount you have spent on fees, your realized profit/loss, your cash positions, and more.

These insights are very valuable for crypto traders and investors, allowing them to analyze their trading habits, spot potential pitfalls, and improve their edge in the market.

Koinly’s Pricing

Koinly’s pricing seems quite reasonable, considering how much time and hassle the platform can save you. And the other thing is, you only have to pay for Koinly when you are ready to generate your tax report. That means you can create an account, upload your data, review your transactions, track your portfolio, and more, all for free.

When you are ready to generate your tax report, payment can be made by credit/debit card and is priced as follows:

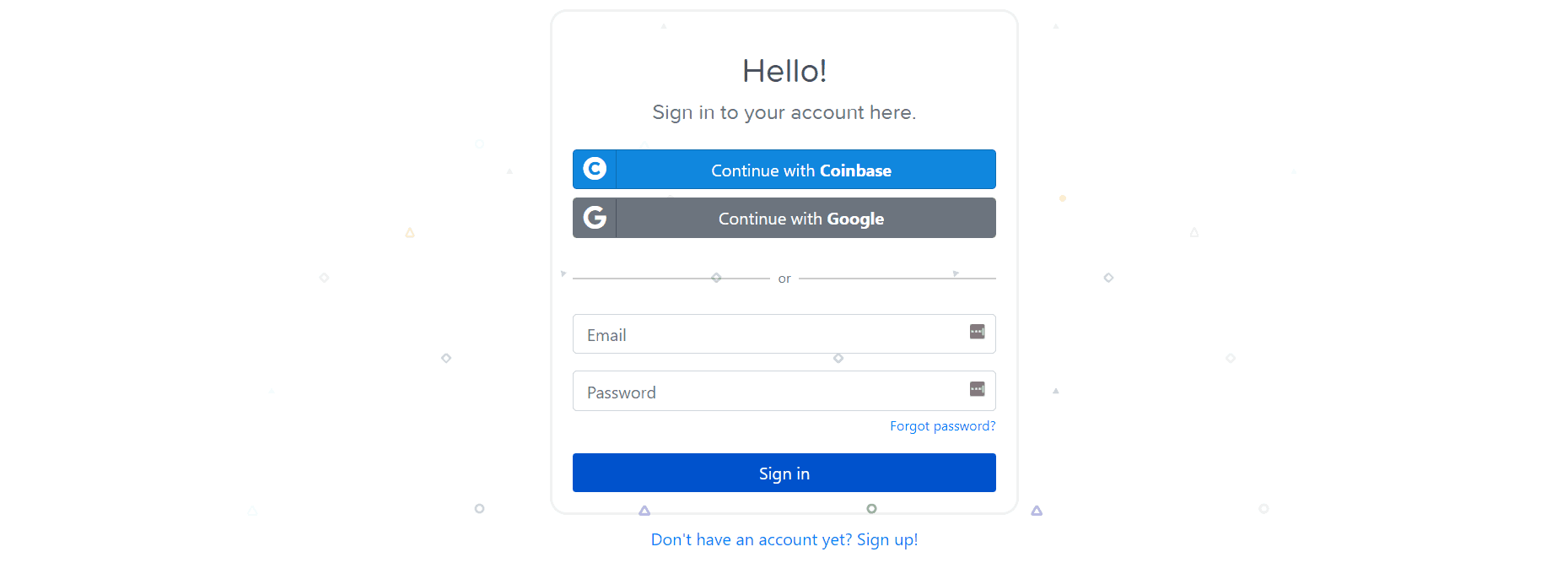

Creating an Account

Creating an account for Koinly is quick and easy. You can either log in with your existing Coinbase or Google account, or create a new Koinly account by entering just a name, email, and password.

A bonus to using your Coinbase account is that all of your Coinbase transaction data will then automatically sync with Koinly.

Final Thoughts

Koinly does exactly what it sets out to achieve, which is to help you manage your crypto taxes simply, quickly, and professionally. Koinly is even in the process of setting up a CPA suite for cryptocurrency accountants and firms to allow them to manage their clients more efficiently.

The platform goes beyond taxes with its portfolio tracker and trading analytics tools. The pricing is fair, considering the time it saves you and the professional and compliant tax reports it produces. On top of that, Koinly’s experienced support team is always on stand by to help you with any issues or queries that may arise.

Overall, Koinly is a solid choice as a tax management platform for crypto traders, investors, and enthusiasts all around the world.

References

- Koinly FAQ

- Koinly Pricing

- How does Koinly work?

Koinly Review: Helping You Manage and Calculate Your Crypto Taxes was originally found on Cryptocurrency News | Tech, Privacy, Bitcoin & Blockchain | Blokt.